CL #7: Investing 101: Warren Buffett's Top Rule for Success

Stick to Your Circle of Competence

In today’s edition, I am going to teach you a simple rule to investing your money successfully.

Everyone wants to invest their money where it will multiply, but there seems to be more ways to lose money than to multiply it.

The reality is that in every venture where some people are losing their money, others are making great returns.

At 93 years old, Warren Buffet is considered the world’s greatest investor as he has consistently made a fortune from long term investments. As of November 2023, he had a net worth of $118 billion placing him as the seventh richest person in the world.

He is the Chairperson of Berkshire Hathaway, a company he built together with his friend and partner, Charlie Munger. The concept of Circle of Competence first appeared in his 1996 letter to shareholders:

“What an investor needs is the ability to correctly evaluate selected businesses. Note that word ‘selected’: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

His partner Charlie Munger puts it this way:

“I don’t play in a game where the other people are wise and I’m stupid. I look for a place where I’m wise and they’re stupid. You have to know the edge of your own competency. I’m very good at knowing when I can’t handle something.”

The concept has since been popularized among investment circles and in the video below, Buffet clearly explains the concept of circle of competence to Terry College of Business students in the University of Georgia:

Investments are not get rich quick schemes

As Buffet clearly explains, before you invest in a business, it is important to understand the economics of the business:

How is value created?

How is profit made?

Is it a sustainable venture?

Unfortunately, most of us treat investments as get rich quick schemes.

Example 1

We listen to the radio presenter who sells to us the dream of unlimited wealth through a green house business that will not require our active involvement.

All we need to do is send our money to the company, they will invest it for us in green houses, then every month we will gain a profit.

Yet we don’t have the fundamental knowledge of how money is made from an agricultural venture.

We don’t ask basic questions such as:

What will they be planting?

Who are the buyers of the produce?

What are the costs of production?

What are the profit margins?

We just send them our money and expect some crazy returns.

But someone who has owned a farm before or worked in a farm would call out the bluff of this scheme.

Farming requires more involvement from the investor.

Telephone farming is always a bad idea.

Example 2

A common ‘investment’ in our country is buying a blog that will make you money as you sleep.

The sales person asks for an initial investment and offers to train you on making money online.

Then they sell you a dummy blog with nothing on it and tell you to use the skills you learnt to grow it.

When you complain, they ask you to recruit others for a commission that will help you recover your money. Pyramid scheme 101.

If you knew how blogs really make money you would not fall for this scheme.

Investments Take Time

Buffet made more than half of his wealth after he turned 50 years old due to the power of compounding.

To give you perspective, he started seriously buying stocks when he was 11 years old.

He spent the first half of his life making great investment decisions that have rewarded him in his second half.

Earnings from investments are a product of time.

But what ultimately made Warren Buffet rich is not purely investments. It is also that he started one the most profitable company in the world, Berkshire Hathaway that hit a record $10.8 Billion profit this year. He’s the largest shareholder owning approx. 15% of the business.

What we can learn from Warren Buffet is that making personal investments is great, but starting a business that makes investments is even better.

How to Invest in your Circle of Competence

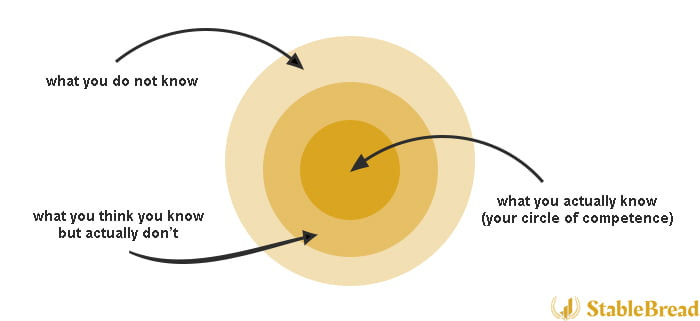

Think of the concept of circle of competence as three circles:

Here, the size of the circle is not important. What is important is knowing the boundaries of what you understand and what you don’t.

To invest within your circle of competence, simply invest in companies or industries that you're very familiar with.

This concept also relates closely with playing to your strengths, as Charlie Munger says it:

You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.

To make this practical, here are important questions to ask before you invest in a company:

What products/services does the company sell?

What market are they selling to? Is the market growing or shrinking?

What is their competitive advantage?

What makes them profit? What are the profit margins?

What's driving the company's growth?

Who is the management team? How competent are they?

What are the company’s key costs?

How do other companies in the industry operate?

What are the related risks to investing in the company?

You can grow your Circle of Competence by thoroughly researching an organization and its leadership. Also read their financial reports and ask questions and visit their establishment if you can.

Remember that you just need to understand the economics of the business you’re investing in and you’ll save yourself some heartbreak.

Disclaimer: I am not a financial advisor. The content of this article reflects my opinion on money and is for educational purposes only. Do your own research and consult a licensed financial advisor.

That’s it for today! If you enjoyed this post, please support me by taking two actions:

Enjoyed reading this. Thanks for the insights