CL #9: Charlie Munger on Business, Investing and Life.

14 lessons from the legendary investor Charlie Munger.

Charlie Munger was an American businessman born on January 1, 1924. He was the Vice Chairman of Berkshire Hathaway, a conglomerate he ran with Warren Buffett.

Charlie died last week on Tuesday, 28 November at the age of 99, according to a statement from Berkshire Hathaway.

Munger was known for his quick wit and wisdom in life and investment. He has been a friend and business partner to Warren Buffet for 60 years.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,”

- Warren Buffet

Here are 14 Lessons from Charlie Munger on business, investing and life.

#1: On Focus

"I don't like multi-tasking. I see these people doing three things at once and I think, God, what a terrible way that is to think."

“I succeeded because I have a long attention span.”

#2: On Learning

"I constantly see people rise in life who are not the smartest–sometimes not even the most diligent–but they are learning machines. They go to bed every night a little wiser than when they got up and wake up every morning able to attack the problems they faced the day before."

“Those who keep learning, will keep rising in life.”

#3: On Thinking

"We both (Charlie Munger and Warren Buffett) insist on a lot of time being available almost every day to just sit and think. That is very uncommon in American business. We read and think."

#4: On Making Decisions

“Instead of looking for success, make a list of how to fail instead–through sloth, envy, resentment, self-pity, entitlement, all the mental habits of self-defeat. Avoid these qualities and you will succeed. Tell me where I’m going to die so I don’t go there.”

"It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent."

#5: On Strengths

“I think about things where I have an advantage over other people. I don’t play in a game where the other people are wise and I’m stupid. I look for a place where I’m wise and they’re stupid. You have to know the edge of your own competency. I’m very good at knowing when I can’t handle something.”

“You’ll do better if you have passion for something in which you have aptitude. If Warren had gone into ballet, no one would have heard of him.”

#6: On Opinions

“We all are learning, modifying, or destroying ideas all the time. Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider arguments on the other side.”

"I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do."

#7: On Investing

“You’re looking for a mispriced gamble. That’s what investing is. And you have to know enough to know whether the gamble is mispriced. That’s value investing.”

“The big money is not in the buying and selling, but in the waiting”

There isn’t a single formula. You need to know a lot about business and human nature and the numbers… It is unreasonable to expect that there is a magic system that will do it for you.”

“There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.”

#8: On Risk

“When any guy offers you a chance to earn lots of money without risk, don’t listen to the rest of his sentence. Follow this, and you’ll save yourself a lot of misery.”

#9: On Choice and Opportunity Cost

“Opportunity cost is a huge filter in life. If you’ve got two suitors who are really eager to have you and one is way the hell better than the other, you do not have to spend much time with the other. And that’s the way we filter out buying opportunities.”

#10: On Simplicity

“We have a passion for keeping things simple. If something is too hard, we move on to something else. What could be simpler than that?”

“Our ideas are so simple that people keep asking us for mysteries when all we have are the most elementary ideas.”

“Take a simple idea and take it seriously. People under-rate the importance of a few simple big ideas.”

“You don’t have to hire out your thinking if you keep it simple.”

“Where you have complexity, by nature you can have fraud and mistakes. You'll have more of that than in a company that shovels sand from a river and sells it.”

#11: On Integrity

“Remember that reputation and integrity are your most valuable assets – and can be lost in a heartbeat.”

#12: On Dealing with reality

“I think that one should recognize reality even when one doesn’t like it; indeed, especially when one doesn’t like it.”

#13: On Change

“Those who will not face improvements because they are changes, will face changes that are not improvements.”

“At Berkshire there has never been a master plan. Anyone who wanted to do it we fired, because it takes on a life of its own and doesn’t cover new reality. We want people taking into account new information.”

#14: On Business and Friendship

“I have three basic rules. Meeting all three is nearly impossible, but you should try anyway:

Don’t sell anything you wouldn’t buy yourself.

Don’t work for anyone you don’t respect and admire.

Work only with people you enjoy.

I have been incredibly fortunate in my life: with Warren I had all three.”

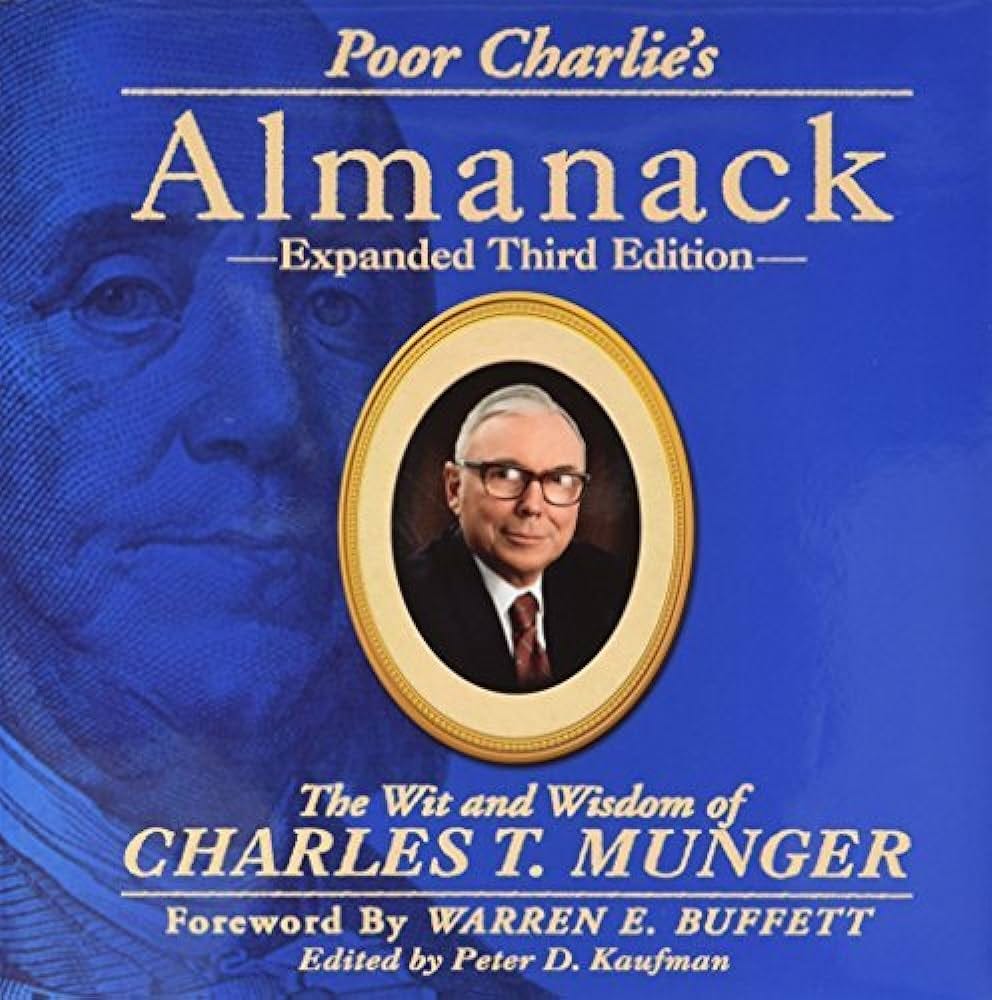

To gain more wisdom from Charlie Munger, read his collection of speeches and talks compiled by Peter D. Kaufman published as Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger

"This book is something of a publishing miracle—never advertised, yet year after year selling many thousands of copies from its Internet site."

– Warren Buffett

That’s it for today! If you enjoyed this post, please support me below:

Thank you for putting together these timeless nuggets of wisdom from a man who has proven that a successful life need not be a complicated life.